New Resource: Structuring the Sale of Your Business - Asset vs. Stock

1 min read

One of the first things you and your buyer will need to agree on is a way to structure the sale. This will be done either as an asset sale or a stock sale. But because you each have different interests, what’s best for your buyer may not necessarily be what's best for you as the seller. Understanding the differences in how asset and stock sales are structured is essential for ensuring you attain the results you desire from the sale.

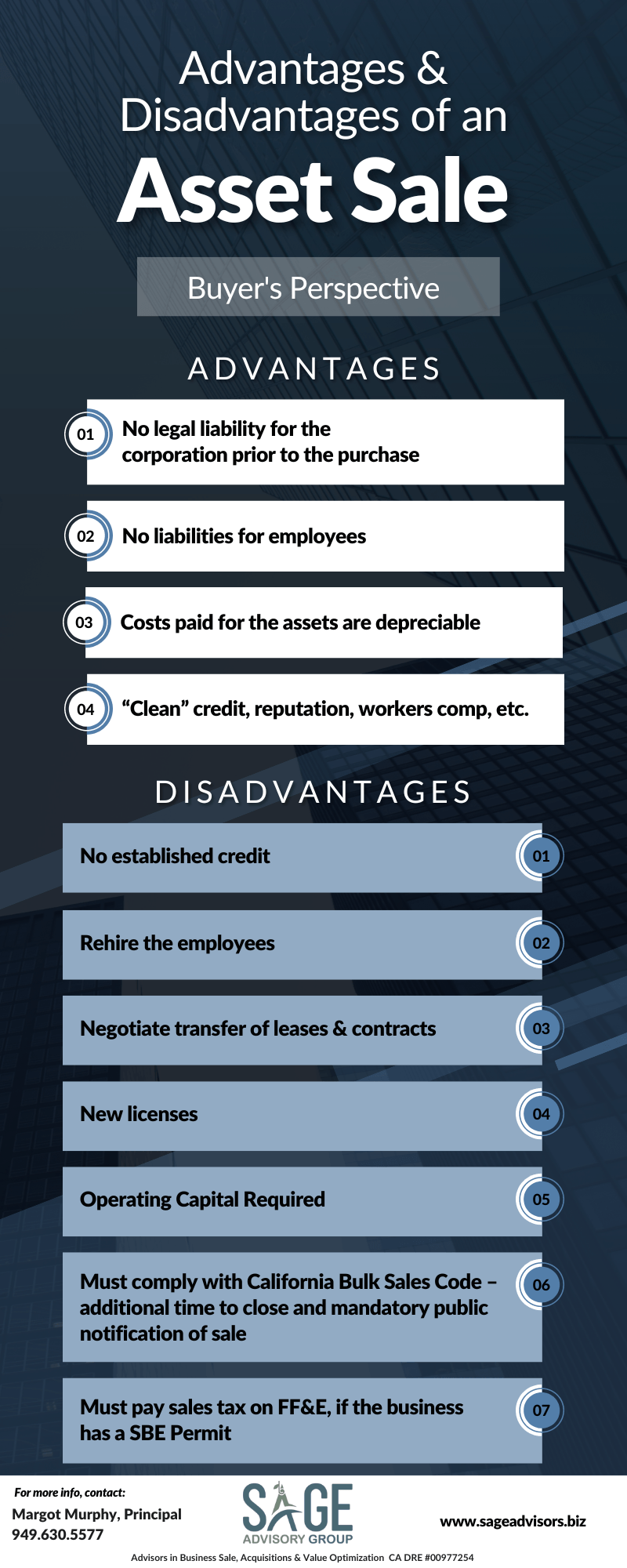

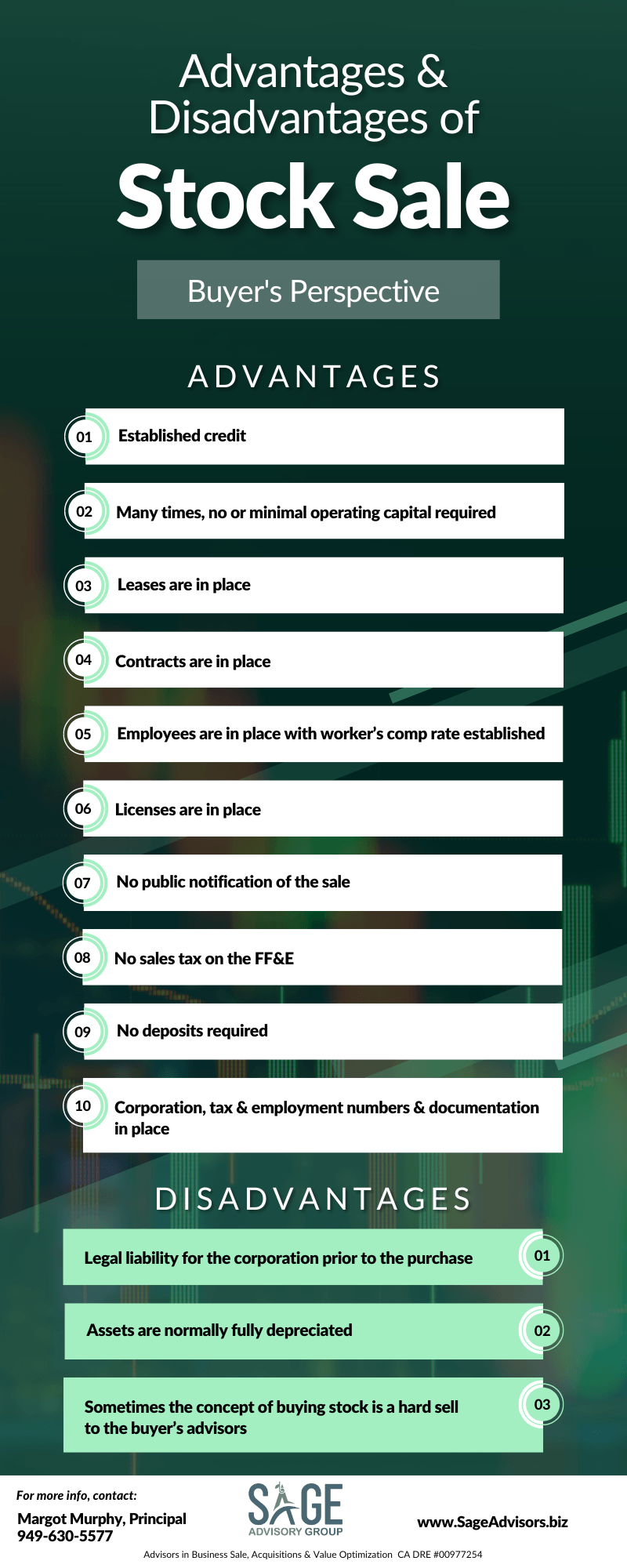

Tax implications and potential liabilities are among the many considerations when negotiating the structure of the sale. Since stock and asset sales affect these issues in different ways, we have found that buyers typically prefer asset sales, while sellers generally opt for stock sales.

An asset sale involves the purchase of individual assets. These are generally cash-free, debt-free transactions. The seller retains its cash and long-term debt obligations and stays in control of the legal entity.

The buyer purchases the company’s individual assets — such as equipment, fixtures, leasehold improvements, licenses, goodwill, intellectual property, trade secrets, trade names, website URLs, phone numbers, software and software licenses, customers lists, and covenants not to compete. Under an asset sale, typically the seller will abandon the DBA and the buyer will adopt the DBA through the California Secretary of State. The buyer will generally also formulate a new, or utilize an existing corporate entity or partnership, through which the DBA will operate within for tax filing purposes.

Whereas in a stock sale, which in some ways may seem less complex than an asset sale, the buyer purchases the seller’s share in a corporation or the seller’s interest in an LLC or membership in a partnership -- securing ownership of the seller’s legal entity through a purchase of the shares.

Liabilities IE A/P and Assets, IE A/R, can be individually negotiated and agreed to by the parties within the stock transfer agreement. Reasons beneficial for a stock purchase are if, for example, there are revenue generating contractual relationships held specifically under the entity's name. In this case, if a buyer were to buy assets only, they could risk losing those contractual relationships since the entity holding the contract would cease to exist. In addition, oftentimes necessary insurance policies and licensing required for operations could be lost if assets-only are transferred through sale.

Deciding how to structure the sale of your business, can present some challenges. Be sure to take time to carefully weigh your options before deciding how to structure your transaction. Talk with a trusted Business Broker, Attorney, and CPA early in the process to fully understand which option will provide the longest-term benefit of a sale so a buyer doesn't overly risk losing revenue-generating contracts or licensing needed to transition the going concern under new ownership.

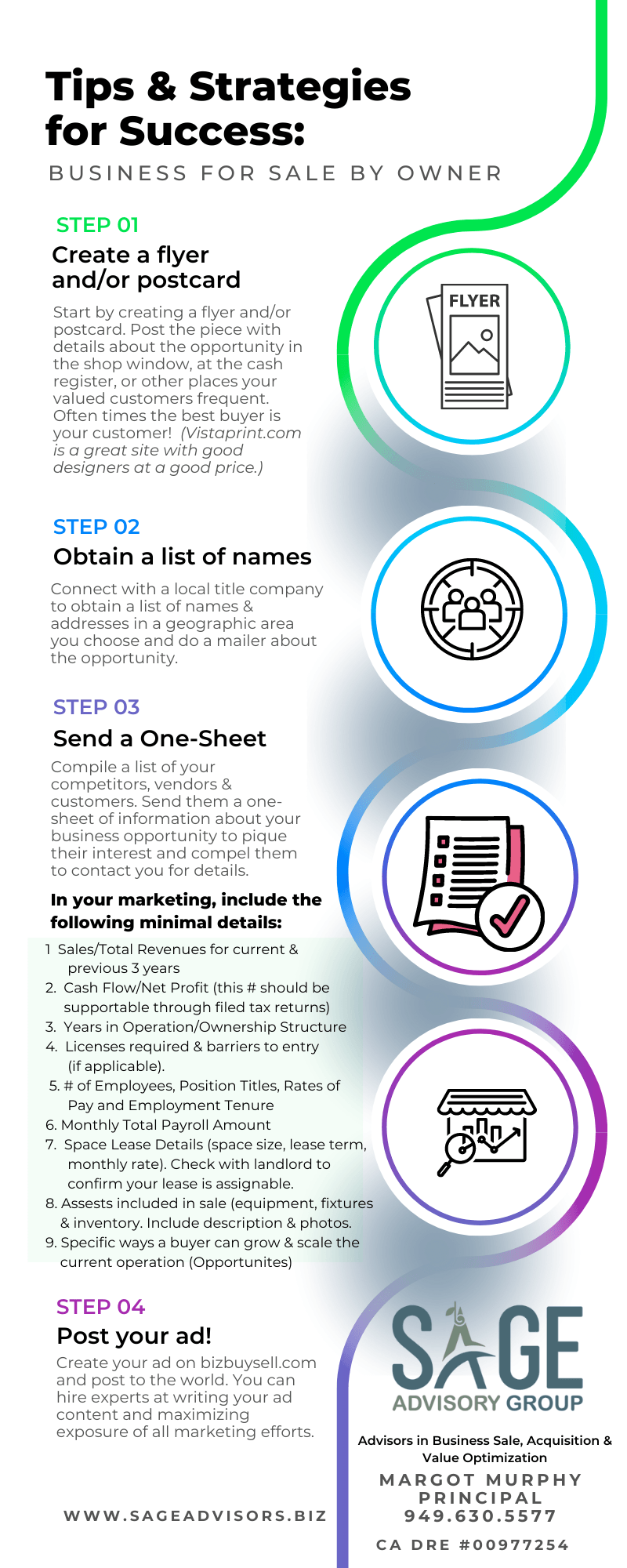

To help give you an overview of the advantages and disadvantages of Asset Sale and Stock Sale, we've created these free resources for you. Click on an image below to download.

For more information or to discuss which is right for you, click here to schedule a consultation or contact us at 949-630-5577.

Margot Murphy is the Principal Broker of Sage Advisory Group, a California Business Brokerage firm which acts as a marketing engine, sale facilitator and sell-side representative for business owners and corporations seeking to transfer sale of companies generating $2mm - $15mm annual revenue.